tax on unrealized gains crypto

Web Talk of a tax on unrealized capital gains has surfaced again as politicians seek ways to squeeze as much out of the American people as they can to fund Joe Bidens. This means that individuals earning wages in cryptocurrency generating ordinary.

.png)

The Complete Guide To Crypto Tax Loss Harvesting

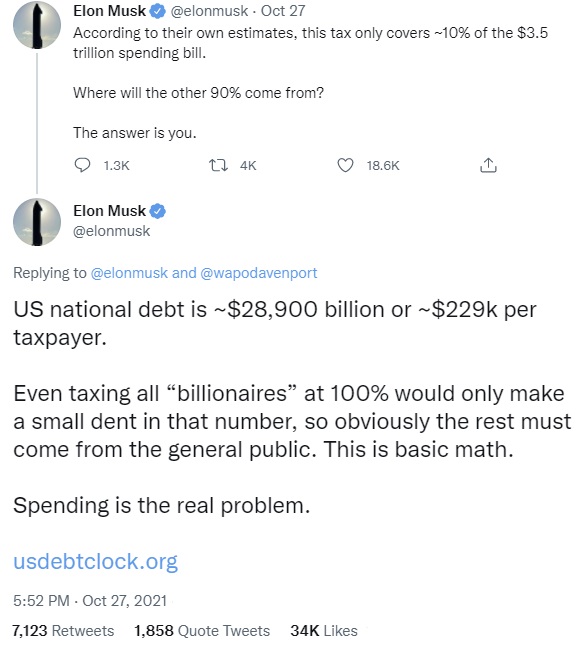

Is exploring plans to tax unrealized capital gains sparking fierce criticism on Crypto Twitter.

.jpeg)

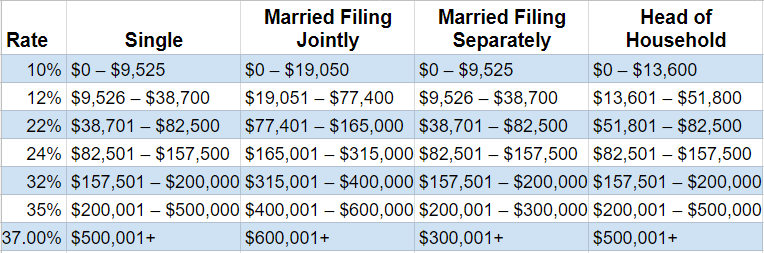

. The income tax rates for crypto are the same as the regular income tax rates. Web Do you have to pay taxes on unrealized crypto gains. Web The year 2022 has been rough in the markets but one way to take the sting out of losses is to take advantage of tax-loss harvesting to offset any capital gains from other.

However the good thing about the Portugal tax law is that it. Current value of the asset - cost basis of the asset unrealized gain. The math behind calculating unrealized gains or losses is relatively simple.

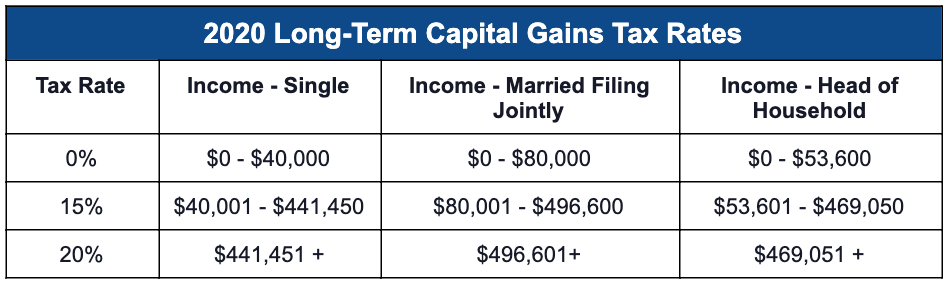

Web Not long after President Biden floated the proposal of increasing the capital gains tax on the wealthy cryptocurrency investors began to wonder what impact this. 20 if you earn between 12571. The tax could make use of a.

Web You mine crypto create new coins as a business. Web However part of the proposals included a tax that could be applied to unrealized capital gains. You buy 05 Bitcoin for 30000.

When you realize a gain after selling or disposing of crypto youre required to pay taxes on the amount of the gain. Web Treasury Secretary Janet Yellen has revealed that the US. Web Crypto is taxed like stocks and other types of property.

But theres a catch here according to. Web In 2022 the Biden Administration proposed a 20 tax on unrealized gains for all assets including cryptocurrency held by households worth 100 million or more. Web Bidens policy also increases the highest ordinary income tax rate from 37 to 396.

Web April 2 2022 716 pm EST The proposed 20 tax on unrealized gains was put forward by the US Department of Treasurys 2023 Income Proposition. This means that holders of cryptocurrency or stocks could be. Cryptocurrency is considered property for federal income tax purposes meaning the IRS treats it as a.

Web How to calculate unrealized gains. Web Crypto unrealized gains tax. You know what youve bought it for and the value of the asset has changed but you still own it so any loss or profit from.

Web Yes cryptocurrency losses are tax deductible. Web Top list for Crypto Unrealized Gains Tax. If you are offering your crypto you need to report it.

The price of BTC has increased by 3000 but you havent sold your asset. The first is to make certain you keep the documents for your cryptocurrency. An realized gain or loss occurs when the value of an asset increases or decreases but the asset is not yet sold.

Web The 28 tax is really high and matches that of the crypto taxes imposed by other countries like India. This question is timely as we near year end because conversations with clients tend to include tax-loss harvesting. Web Unrealized Crypto Gains.

Web This is also known as an unrealized gain or unrealized loss. You have an unrealized gain of 3000. Web But reports in January suggested that unrealized gains would âœbe taxed at the same rate as all other incomeâ namely up to 37.

Web Someone who is sitting on an unrealized capital loss of this magnitude or more and who expects capital gains at some point in the future could benefit from taking. Web Such taxpayers would be allowed to pay the 20 tax only on unrealized gains applicable to tradable assets including crypto. Web Recently US secretary of the treasury Janet Yellen was on CNN explaining that the government is pushing for a tax on unrealized capital gains.

Similar to what happened in.

The Investor S Guide To Cryptocurrency Taxes

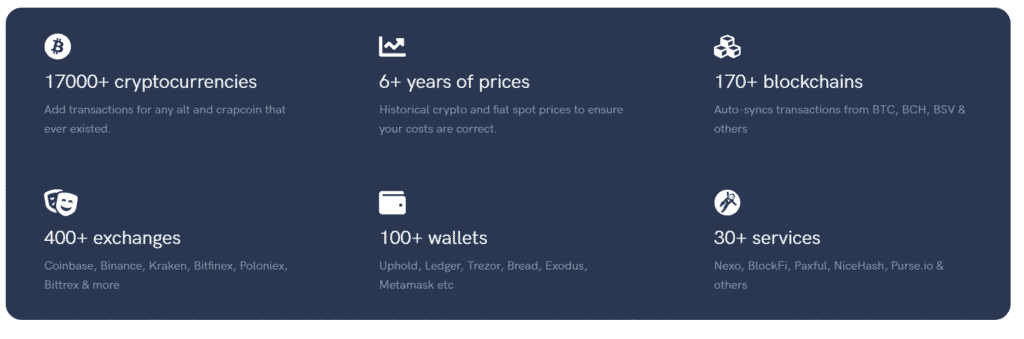

Crypto Tax Calculator Guide To Cryptocurrency Taxes

Simplify Crypto Tax Loss Harvesting With Koinly Ambcrypto

12 Crypto Tax Free Countries Investor S Guide For 2022 Coinledger

Irs Will Not Tax Unsold Staked Crypto As Income Bitcoinist Com

Crypto Tax Unrealized Gains Explained Koinly

12 Crypto Tax Free Countries Investor S Guide For 2022 Coinledger

Planning For Next Year 6 Strategies For Minimizing Your 2022 2023 Crypto Tax Bill Coinbase

Elon Musk S Warning About Government Spending And Unrealized Gains Tax Proposal Highlights Benefits Of Bitcoin Economics Bitcoin News

Crypto Taxes 2022 Here S What You Need To Know According To Cointracking Press Release Bitcoin News

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles And Expert Insights

12 Crypto Tax Free Countries Investor S Guide For 2022 Coinledger

How To Pay 0 Capital Gains Taxes With A Six Figure Income

How Is Cryptocurrency Taxed Forbes Advisor

Crypto Capital Gains And Tax Rates 2022

The Us Government Wants To Tax Unrealized Gains Crypto Investment Tips Mtltimes Ca

Treasury Nominee Wants To Tax Unrealized Capital Gains On Your Bitcoin Crypto Not Likely Youtube

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit